Low-Income Renters Face Eviction, Thanks to the Government Shutdown

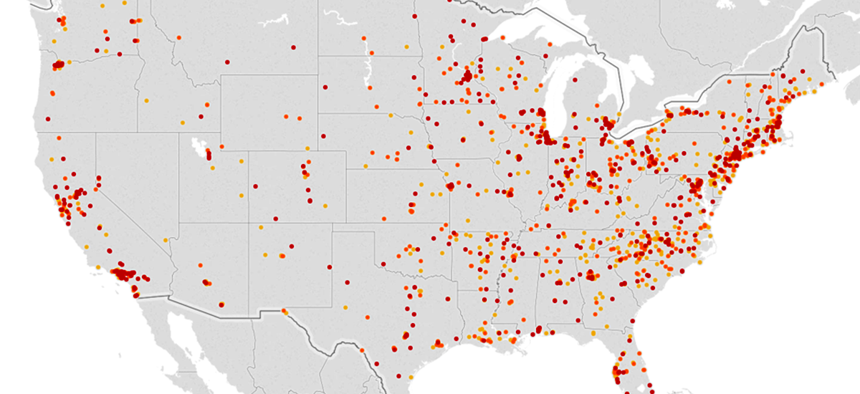

Where the rent checks will stop. National Low Income Housing Coalition

Contracts for federal housing assistance are expiring, and thousands of low-income seniors and disabled renters could face eviction.

With the federal government shutdown in the U.S. nearing the three-week mark and no end in sight, more than 800,000 furloughed workers are starting to feel the sting of missing paychecks and mounting bills. The real-world impacts of this political brinkmanship—from airport-security sick-outs to sharply curtailed food inspectionsto fears that contractors may never see any backpay—are starting to metastasize throughout the economy.

That anxiety is setting on some of the most vulnerable families in America. Between 70,000 and 85,000 low-income households that rely on assistance for housing—many elderly or disabled, and some of whom make less than $13,000 per year—could see shocks to their housing status if the shutdown persists.

On Tuesday, housing advocates issued a letter to top leaders in the House and Senate outlining the plight of vulnerable families during the federal shutdown. Their immediate concerns revolve around a program known as Section 8 Project-Based Rental Assistance, a benefit that favors older renters and people with disabilities especially. Contracts under this program that were up for renewal last month instead expired after the government closed on December 22.

Two-thirds of the people who receive housing aid under this program are seniors or individuals with disabilities; the average income level for these beneficiaries falls below the federal poverty limit. For these fixed-income households, there’s no margin between disruption and despair. And with more Project-Based Rental Assistance contracts set to expire this month and next, the ranks of seniors and disabled people facing a housing crisis may grow.

An interactive map assembled by the National Low Income Housing Coalition shows where these expiring Section 8 Project-Based Rental Assistance contracts are located. The soon-to-be-affected households live in affordable housing developments in nearly every state.

The U.S. Department of Housing and Urban Development’s Project-Based Rental Assistance program differs from the more familiar tenant-based Section 8 vouchers. Under Project-Based Rental Assistance, HUD contracts with private property owners to open up some or all of their rental units to low-income families. To be eligible, at least 40 percent of the units in a development must go to families with extremely low incomes (at or below 30 percent of area median income or the poverty line, whichever’s higher). That makes Project-Based Rental Assistance useful for seniors, people with disabilities, and others on fixed incomes—right up until the federal government stops cutting the checks.

Thanks to the shutdown, roughly 1,150 contracts between HUD and private property owners are already in limbo. Another 500 contracts are set to expire in January, affecting tens of thousands of residents, with another 550 contracts to follow in February. These lost contracts could jeopardize the rental status of 80,000 low-income households or more. That’s in addition to the tens of thousands of residents whose rents are already up in the air, after HUD failed to renew contracts with their landlords last month.

“Without additional funding, HUD cannot renew these contracts or obligate funds,” reads the letter from the Campaign for Housing and Community Development Funding, an umbrella coalition of more than 70 national organizations.

Disruptions stemming from these lapsed contracts are likely to compound. Section 202, for example, provides supportive housing for the elderly; the program is supported by a combination of subsidies through Project-Based Rental Assistance contracts and another category called Project Rental Assistance Contracts. Section 202 provides housing and services for more than 400,000 older adults with average incomes of $13,300. These housing developments could soon go unfunded.

Problems that multiply for low-income households will inevitably hit entire communities. Carol Ott, tenant advocacy director for the Fair Housing Action Center of Maryland, counts 542 units of project-based affordable housing in the Baltimore metro area (plus scattered subsidized homes and apartments that may add up to thousands). “That could mean absolute disaster not only for the residents, but also local economies,” she writes in a tweet.

While urban areas with large low-income populations stand to be severely affected, it won’t be just the Baltimores and Detroits dealing with the ramifications of broken housing, if the shutdown lasts much longer: More than 270,000 rural families also receive rental housing aid. The U.S. Department of Agriculture, which distributes this aid through its Rural Development program, has not indicated yet how far its rural housing funds can stretch. But the Idaho State Journalreports that local rural housing authorities are already dipping into savings to cover aid for tenants.

The true housing aid cliff, however, looms in February. If the federal shutdown isn’t resolved before the end of next month, Section 8’s tenant-based Housing Choice Voucher program will run out of funds—meaning public housing authorities will not be able to pay out vouchers to landlords for millions of households across the country when the rent comes due on March 1. The USDA’s Supplemental Nutrition Assistance Program can only guarantee food benefits through February, too, which means that some truly unlucky families could face the prospect of eviction and hunger. A federal government shutdown stretching beyond February would be unimaginably chaotic.

But the shutdown wouldn’t have to reach these kind of endgame scenarios to trigger a crisis; to do that, it won’t even need to extend through February. For landlords whose contracts with HUD for low-income properties expired in December, the end of January will mean a second month that they don’t receive federal subsidies. Landlords use those contract subsidies to make mortgage payments, perform maintenance, and pay staff. Few people expect that Uncle Sam missing a single month’s rent will lead to widespread evictions (although they’re bound to happen). But two months in a row?

Days into the federal government shutdown, the U.S. Office of Personnel Management posted sample letters that they suggested federal workers give their creditors and landlords, in lieu of payment. (Helpful advice: “If you need legal advice please consult with your personal attorney.”) It was laughable then; two weeks later, it feels more like gallows humor, as feds face tough questions about stretching their budgets from paycheck-to-no-paycheck.

For extremely low-income seniors and disabled people who depend on federal housing aid for rent, there is not going to be any belt-tightening or consultation with personal attorneys. If landlords can’t afford to house them, then they’ll face eviction; if federal agencies can’t afford to feed them, then they can’t buy food. The toll of the federal shutdown extends beyond closed museums and overflowing trash cans on the National Mall, and it affects more and different people than the faceless bureaucrats that conservatives sometimes imagine as the justifiable casualties of budget wars. Real pain from this shutdown is surfacing in small towns and cities across America—not next week or next month, but right now.

The real price of President Donald Trump’s border wall isn’t the billions of dollars that Democrats in the House are never going to give him. It's the many thousands or even millions of vulnerable people that will suffer for as long as this farce lasts.

NEXT STORY: Moonlighting Feds Could Be Risking Their Jobs