Outlook bleak for fiscal 2014 defense funding

Jobs, military assets, R&D and technological superiority are all at risk.

Top military officials and federal budget experts are predicting more cuts and greater uncertainty as the fiscal 2014 budget and appropriations process looms.

The Defense Department and defense contractors particularly are poised to take hits in fiscal 2014, sources indicated.

"The picture isn't pretty...we are headed into a very difficult time," Frank Kendall, undersecretary of defense for acquisition, technology and logistics, said at an industry event in Washington on Sept. 4, National Defense reported. "It is very hard for us to manage these abrupt cuts."

The next day, Chief Naval Officer Adm. Jonathan Greenert painted an equally grim picture for the Navy, saying the service faces a $14 billion reduction that could more than halve its ship availability.

"Usually, we have three carrier strike groups and three amphibious ready groups able to respond within a week," Greenert said at the American Enterprise Institute in Washington. "We have one now, and that's going to be the story in fiscal 2014."

Greenert also predicted reduced training, cuts to shipbuilding, continued hiring freezes, the loss of about 25 aircraft and a possible reduction in force. He said the Navy will start voluntary civilian retirement programs as soon as Oct. 1, the first day of fiscal 2014, in hopes of heading off involuntary force reductions.

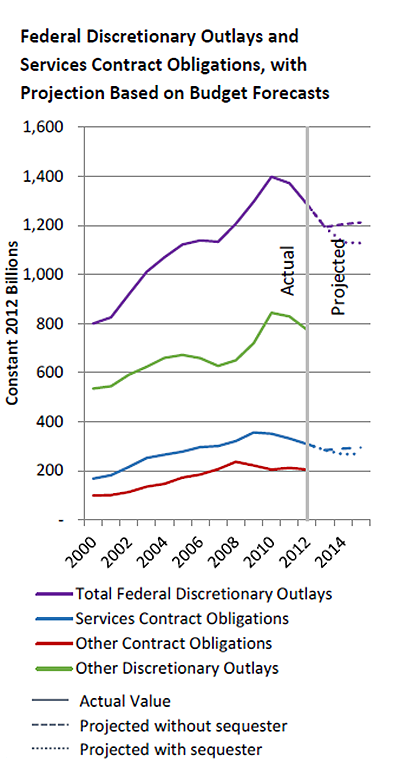

The bleak outlook extends far beyond the uniformed services. A new study from the Center for Strategic and International Studies shows that contractors also face a bearish business environment, including a likely decline in contracts over the next two years attributable to sequestration.

"Overall, this report shows the beginning of a decline in federal services contracting that is largely commensurate with the declining overall federal budget and expenditure levels," the report's authors wrote. "It remains to be seen whether the 2013 levels, with the impact of sequestration under the Budget Control Act of 2011, will maintain that relationship or not."

Federal information and communications technology contracts are in decline from a 2011 high-water mark, according to the study, with information technology efficiencies such as cloud computing and virtualization a possible contributing factor.

Information and communications technology, or ICT, contracts are in line with an overall decline in federal services contracts in the same period, CSIS said. Between 2011 and 2012, the study said, overall contract spending on services fell from $331.5 billion in 2011 to $307.8 billion in 2012, a seven percent decline. That trend is likely to continue.

The report drew data from the government's Federal Procurement Data System (FPDS) from fiscal 2000 through fiscal 2012.

Projected declines in spending, with and without sequestration. (CSIS graphic)

Although it found the biggest decline was for professional, administrative and management support (PAMS) contracts, the study said government ICT contracts fell by more than $2 billion, or six percent, from 2011 to 2012.

GSA ICT contract obligations also declined 5.2 percent between 2010 and 2012, while contract obligations for PAMS increased 21.2 percent comparatively among the five areas measured by the study. Equipment related services, research and development, and medical services all saw increases in the period, but none of the three exceeded $300 million in any given year, according to the study.

Along with the government budget cutbacks, a small part of the decline in ICT contracts could be due to increased IT efficiencies derived from virtualization and cloud applications. "ICT has traditionally been slower" than the other sectors the group studied, said Greg Sanders, CSIS fellow and one of the study's lead authors. "It has dropped off 1 percent since 2009. While that indicates the overall government environment, we could be beginning to see some benefits from virtualization."

The government's use of blanket purchase agreements, like those the GSA rolled out for wireless services this past summer, are gaining steady traction, said Sanders. BPAs grew from .25 percent of ICT prime contracts in 2000 to 3.9 percent in 2009 to 4.5 percent in 2013. Government-wide acquisition contracts, like NASA's SEWP, now make up 10 percent of ICT prime contracts, he said, while the use of Federal Supply Schedule contracts for ICT primes continues to drop, from 25 percent of ICT prime contracts in 2000 to 12 percent in 2012.

The Pentagon, which accounts for half of ICT contract obligations, accounted for most of the decline. The Big Six vendors: Boeing, Lockheed Martin, Northrop Grumman, General Dynamics, Raytheon, and BAE, saw a faster decline than overall ICT, it said.

Overall, DOD contracts declined at a rate of roughly 5 percent per year from 2009 to 2012, according to the report, with equipment-related services being a rare bright spot seeing some increase over the past few years. But the report noted that DOD service contract obligations declined by nearly $33 billion in that time, including $15 billion from 2011 to 2012.

Research and development is an area particularly hard-hit by budget cuts. The CSIS report pegged the decline at roughly $4 billion between fiscal 2011 and fiscal 2012, from $39 billion to $35 billion. IT in general peaked in 20911 and has been declining slightly, the report noted.

Kendall highlighted the R&D and technology reductions as particularly worrisome. He said that in the push to quickly slash spending, these investment-type accounts are especially vulnerable and could face up to 20 percent reductions.

"This is a bizarre situation for the United States," Kendall said. "We are seeing growing national security threats but we are unilaterally disarming because of concerns about the deficit and the national debt. This is a very unusual situation for us."

Kendall also expressed specific concern for industry, which he indicated will suffer ripple effects of cuts if there is no congressional intervention – a prospect for which he was not optimistic. The end result of that could mean "tens of thousands" of job losses, he said.

"I am increasingly concerned about our technological superiority," Kendall said. "I don't think people understand as much as they should that our technological superiority is not assured at all," with prospective enemies "designing systems to be better than ours and to defeat ours."